By Mark Kastel

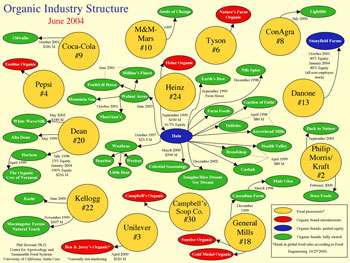

A thought-provoking question came in from an astute observer of the natural foods industry regarding my article in the July/August Cooperative Grocer: “Reclaiming the True Meaning of Organic.” She wanted to know about some of the corporate ownership stakes in familiar organic brands. Are megacorporations, including Heinz, General Foods, Dean, Campbell’s, and many others, simply acting as investors, holding minority equity positions in independent corporations, or do they actually own, control, and set policy, for some of the biggest names in organic food?

|

| Chart of organic industry ownerships. Click here for a high-rez popup or here for a downloadable pdf suitable for printing. |

I will take two different examples of corporate investment in organic food and show how they are playing out.

Dean Foods, the largest milk bottler in the United States, with 29,000 employees and sales in excess of $9 billion, purchased White Wave and Horizon Organic over the past 2 1/2 years. Last month they announced that their ownership would be anything but passive. In a management shake-up and major corporate realignment, they have relocated the headquarters for Silk to Boulder, Colorado, where Horizon has always been located, and they combined these two entities, which are, in the words of company Chairman Gregg Engler, “authentic and nutritious,” with other specialty foods including International Delight coffee creamers, Hershey’s milk/milk shakes and Dean’s dips.

Obviously, not everyone in the organic community might view nondairy coffee creamer as being authentic and nutritious-strange bedfellows indeed.

Dean has lopped off some of the upper management at Horizon and has brought in a new corporate team. The labeling on Silk or Horizon brand products will not allude to their corporate ownership and they will not talk about their 4000 cow “organic” farms or imported soybeans from Brazil. Consumers looking for true integrity and authenticity are handicapped, and buyers at cooperative groceries have the opportunity to step in and help in discerning purchasing decisions.

Another example of corporate investment in organic food marketing is the H. J. Heinz Co. of Pittsburgh. About the same size as Dean at just under $10 billion, the company is known for its flagship line of tomato products and other consumer favorites such as Kibbles n’ Bits. In the case of Heinz, they’ve taken a wholly different tack.

First, they made a major investment in Hain, which would later acquire and merge with Celestial Seasonings to form the now gargantuan, in terms of organic market presence, Hain/Celestial. As many know, Hain/Celestial controls a multitude of major brands including Walnut Acres, Arrowhead Mills, Health Valley, and many, many others. Heinz originally purchased 20% of the stock in Hain/Celestial and then transferred the assets of a number of their product lines, including Earth’s Best baby food and Ethnic Gourmet. It is not easy tracking the labyrinth of corporate investment, transfers, and control of these large publicly held corporations, but under Security and Exchange Commission law we can do a certain amount of research. Also, some corporations are more open than others. According to one of the top corporate communications officers at Heinz, Jack Kennedy, their stake in Hain/Celestial, after all the transfers and additional equity growth, stands at approximately 16%. They also have two of their officers on the Hain/Celestial board of directors.

When asked, after their substantial investments, whether they had the right to purchase additional stock or wholly take over the company, Mr. Kennedy said he was not at liberty to discuss their future plans. Obviously, corporations do not make these kinds of investments altruistically; they’re looking for future growth and income potential.

As with Dean or Dannon (Stonyfield), observers can debate the level of influence the corporate managers have on day-to-day operations and whether this type of investment is good for organic consumers and farmers.

The second thrust of the Heinz involvement in organics is much more transparent. They have made major investments and are an organic leader in England and the EU, marketing tomato products, baked beans, and other familiar fare.

In the United States, they have only one organic SKU, their flagship brand and category leader, ketchup. They weighed the positive and negative of associating their name with the credibility of an organic label and decided, based on market research, that there was a strong audience for an organic version that could deliver the familiar Heinz ketchup taste.

|

| “Are megacorporations simply acting as investors or do they actually set policy?” – Mark Kastel |

According to Robin Teets, with the Heinz North American group, in the first 12 months after their product launch there was a 60% growth in the organic ketchup category and Heinz accounted for the majority of that volume. Rank-and-file organic consumers are certainly voting in favor of some corporate involvement.

However, it should be noted, that not only are they proud to use their name on organic products, not afraid of politically correct naysayers, and not concerned about devaluing their conventional offerings, they are also producing this product with a high level of integrity. Instead of choosing an organic certifier that would be more commonly associated with corporate organic players, or importing concentrated tomato products, their fresh tomatoes are grown on California farms and certified by Oregon Tilth.

The Cornucopia Institute has suggested that measuring corporate behavior, in terms of organic integrity, should be scale neutral. Operating 2000-3000 cow factory farms, scoffing at the federal law requiring pasture, or imported vegetables from China with dubious environmental pedigrees are unacceptable whether the products are generated by large international corporations or a small mom-and-pop enterprise. Corporations that truly subscribe to maintaining a high ethical standard for organics, as opposed to paying lip service and developing slick eco-friendly marketing campaigns, should be applauded and welcome as part of our community.

The Cornucopia Institute is currently doing research in order to provide co-op buyers and members with a web based tool to evaluate the practices of major players in the organic arena. We are starting with organic dairy but will also do comparisons of meat, poultry, egg and vegetable production, among other product categories. More information can be found on www.cornucopia.org.

[A version of this story appears in the September/October issue of “Cooperative Grocer.”]